Why It Matters

Finance teams need more than static reports. This suite blends internal ledgers with macro indicators, then uses Python forecasting and Power BI storytelling so boards can see the next 6–18 months before it happens.

Solution Overview

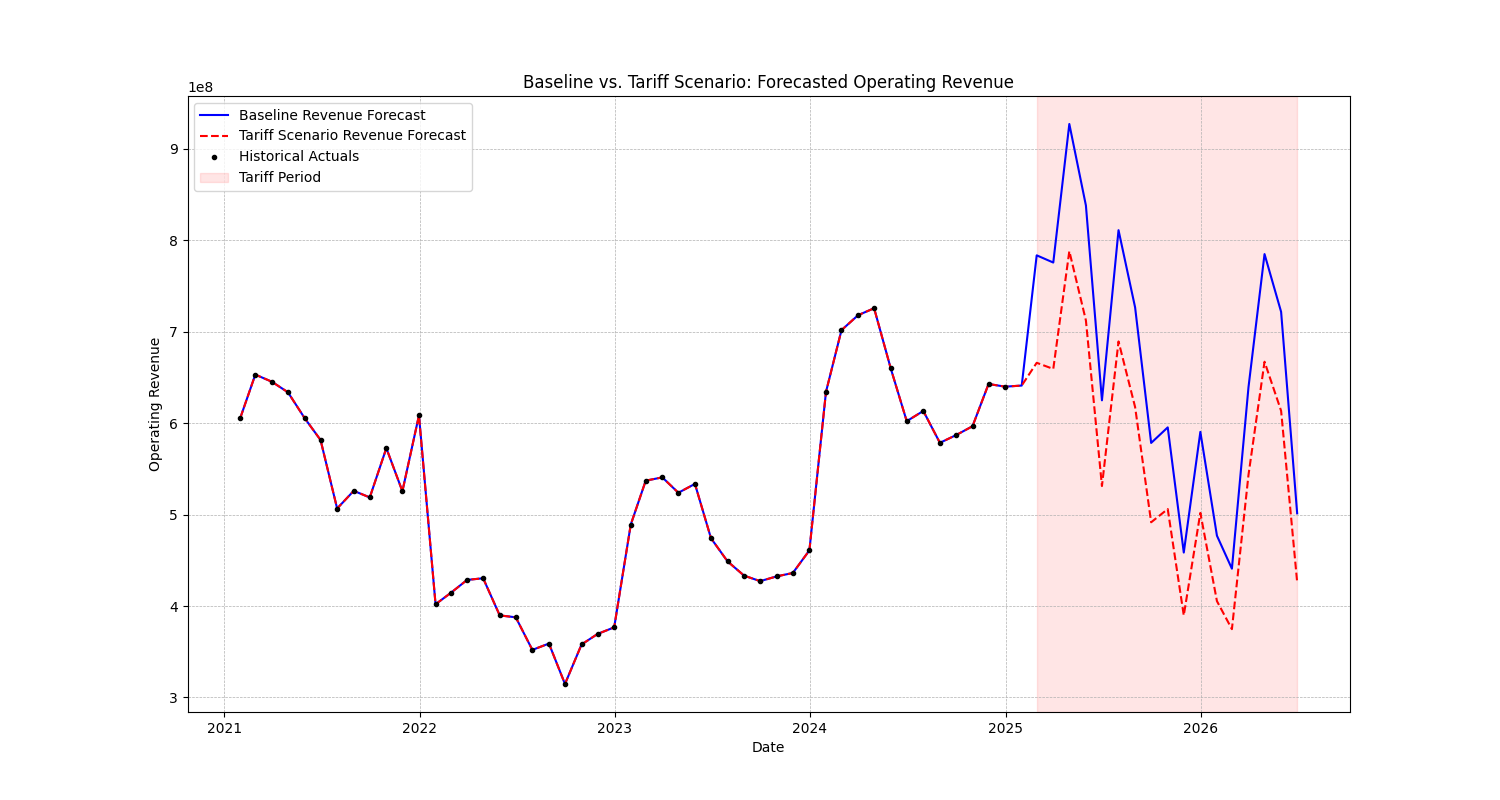

- Module 1 – Predictive Cash Flow: SQL pulls historical ledgers, Python (Pandas, Prophet, scikit-learn) blends in external economic signals, and forecasts land in Power BI.

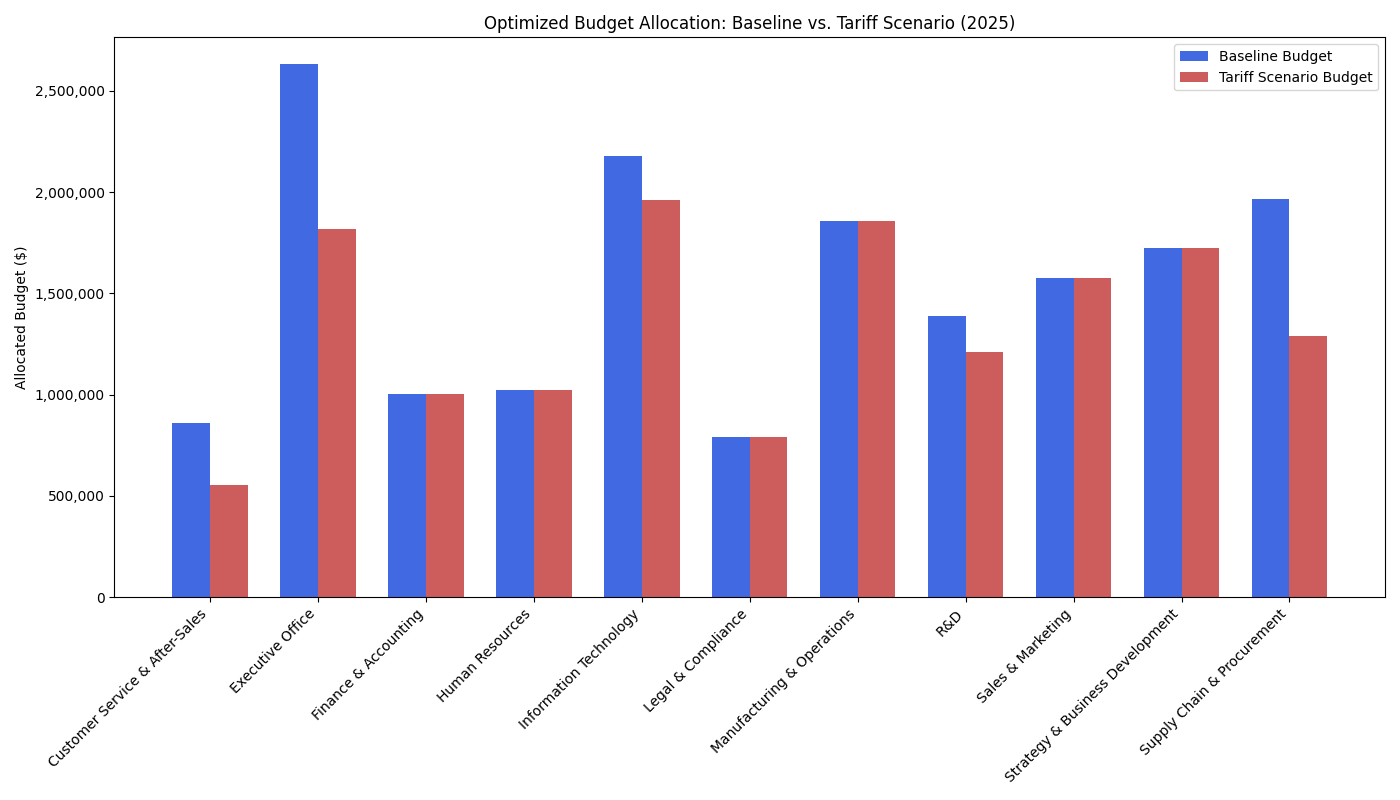

- Module 2 – Budget vs. Scenario Engine: Users adjust growth, hiring, and pricing levers, and DAX-based measures show best/base/worst case outlooks.

- Module 3 – Storytelling Layer: Dynamic commentaries and spotlight cards automatically surface material deltas for executives.

What Stakeholders See

- Unified timeline of historical cash, current bank positions, and scenario-adjusted forecasts.

- Budget optimization screen comparing strategic bets (organic growth, acquisitions, efficiency lean-ups).

- External indicator overlays so leadership can explain “why the model changed” in plain language.

Highlights

- APIs + scraping for macroeconomic indicators.

- Version-controlled SQL + Python notebooks to reproduce every forecast.

- Executive artifacts (PDF packs, images) generated straight from the dashboard for board updates.

Applicable Beyond Finance

This template works for any domain that needs predictive planning—member growth, grant funding, even workforce planning. Swap the metrics, keep the ingestion, modeling, and storytelling layers.

Gallery